Defining Market Failure (with Examples) - EdChoice

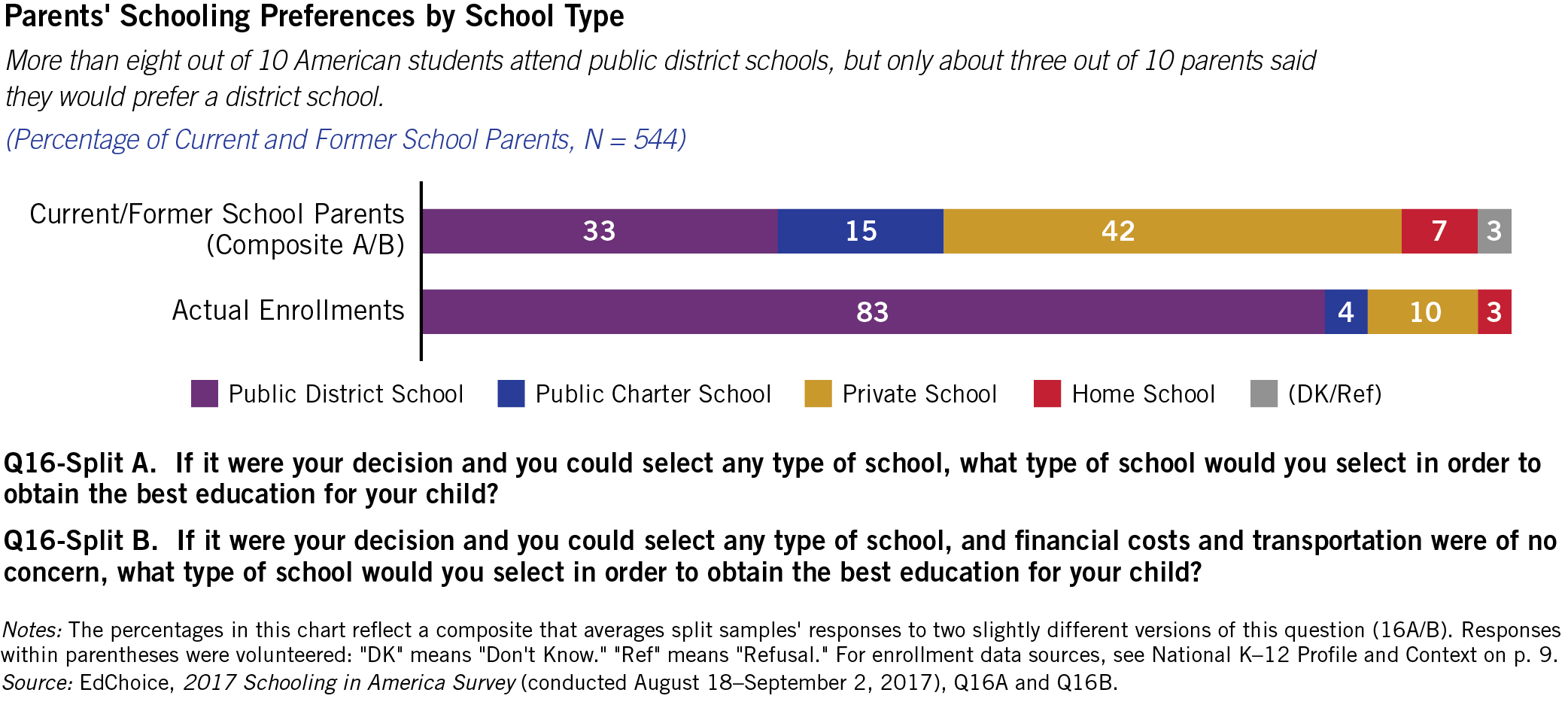

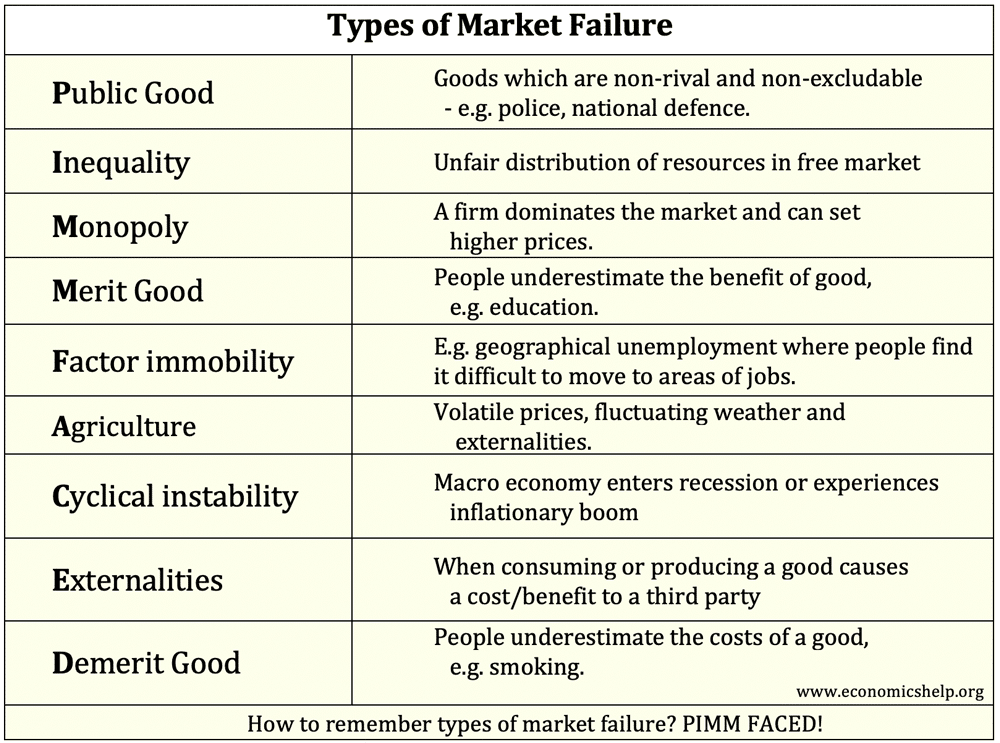

But markets aren’t always perfect, and certain conditions may prevent market equilibrium. Market failure is an economic term applied to a situation where consumer demand does not equal the amount of a good or service supplied, and is, therefore, inefficient. In markets with high levels of competition, companies and organizations have an incentive to produce goods and services that consumers value, at low cost. If they do not meet consumer demand or fail to keep prices low, then the company or organization will lose money or go out of business because consumers can easily find substitutes elsewhere.But instead of government intervening in this case, another pharmaceutical company created a close substitute that provides patients relying on Daraprim with a potential alternative. The case for government intervention in the face of market failure may be more nuanced than what some may perceive.The main types of market failure include asymmetric information, concentrated market power, public goods and externalities.Though there are other types of market failure, in this piece I discuss the four most common types of market failure with examples from various industries.

:max_bytes(150000):strip_icc()/Market-Failure-V3-ab96ad16afee413ea84ce9c9fe30038d.jpg)

:max_bytes(150000):strip_icc()/GettyImages-637925346-0f4d0620fc324aa0b496c0c318e51dc7.jpg)